Are Austin property taxes actually high?

How does Austin compare to other Central Texas cities?

Any property owner in Austin knows they pay high property taxes, but in my experience, relatively few know why they pay high taxes.

Simply put, the biggest taxer by far in Austin is the school district. It collects about half of all of the property taxes. But of course, for every dollar AISD raises to fund its own expenses, it also must raise nearly another dollar to send to the state of Texas. Contrary to popular belief, "recapture" or "Robin Hood" is not necessary to fund public education in districts with low property values. It's simply a policy decision by state government to fund K-12 education through what is essentially a state property tax on the residents of Texas's major cities and suburbs.

Nevertheless, for as long as I've covered City Hall in Austin it has been common for people to blame city government for their tax bill. I suspect that is because city government is the most identifiable local political entity and its spending decisions receive far more coverage than that of the other taxing jurisdictions.

But two things can be true. Austinites could be paying up the wazoo to Greg Abbott and City Hall. Are they?

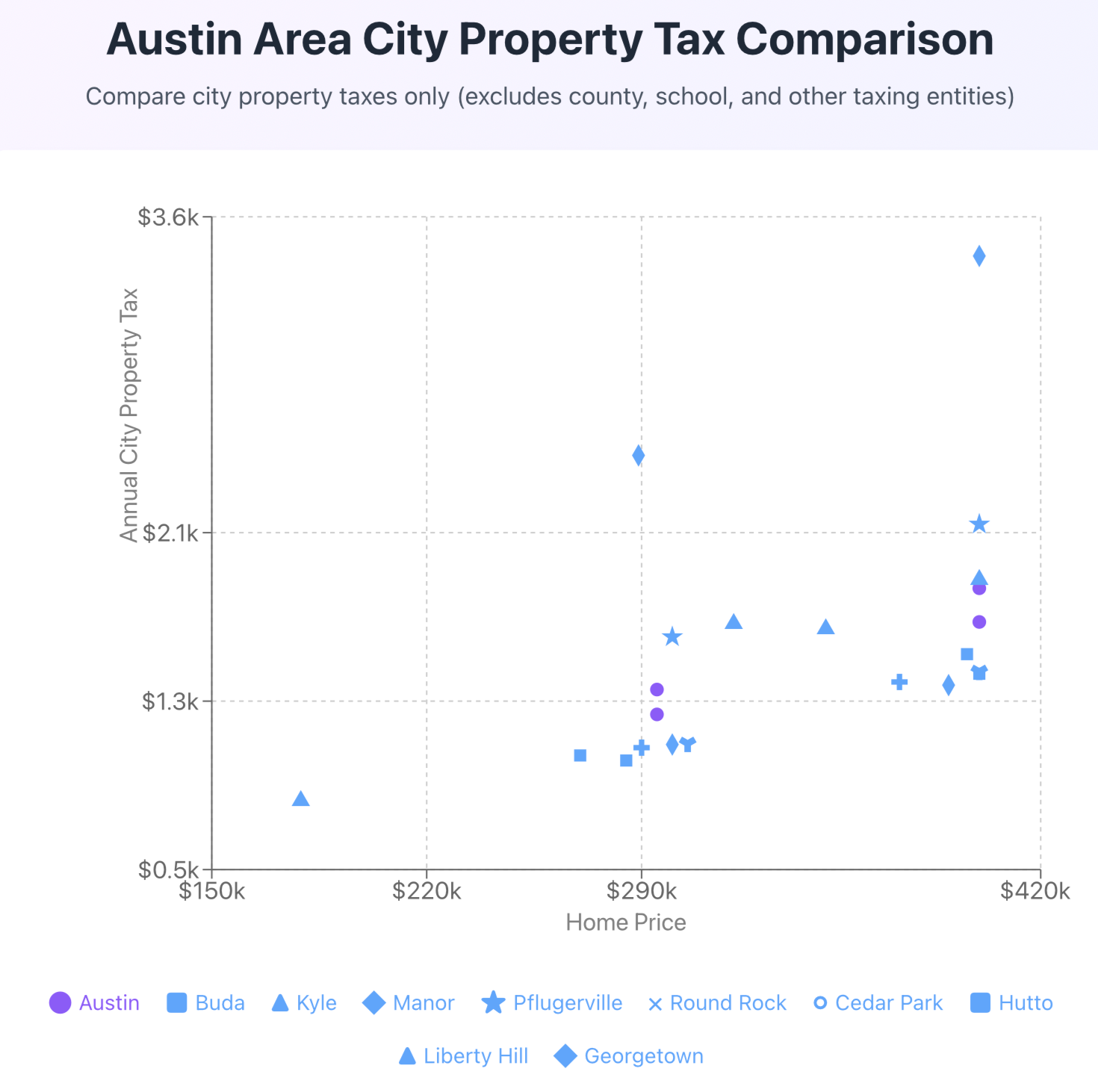

I would say the status quo in Austin is not particularly high compared to other municipalities in the region, especially considering that Austin, as the region's big city, simply has to deal with problems that bedroom communities like Cedar Park don't.

Comparing taxes between cities is tricky. The tax rate that a city levies is straightforward, but whether the rate actually leads to high taxes depends on property values, which of course can vary dramatically between cities. The city of Austin often reports what the tax is on a "median" homestead in the city, but many other cities don't appear to do that.

So what I did was imagine a young family looking for a three-bedroom house in the Austin area with a budget of $400,000. That is the max they'll spend, but they'll happily spend less if they can. So what do the different housing options throughout Central Texas offer in terms of taxes?

The graph below shows the different city property tax burden they'd face in Austin and nine other municipalities. The purple dots on the right reflect what they would pay on a $400,000 house – the higher one if the TRE is approved, the lower one if it's rejected. The two other dots reflect the TRE/non-TRE burden for a $295,000 house.

Below shows what the total property tax burden would be for different jurisdictions.

Keep in mind, this is just for homesteads. Commercial properties pay higher taxes in all jurisdictions, but particularly in Austin, where both the city and county have 20% exemptions for homesteads. Taxes on commercial properties are an issue for renters – we'll talk about that another day.

Keep reading if you want to see me "show my work."

Austin

Let's say they buy this 1,350 sq ft 3/2 at Menchaca & Slaughter for $400,000.

- If voters approve the TRE, the tax rate will be 57.4017¢ (after the 20% homestead exemption), so they would owe $1,836 in city taxes in the upcoming fiscal year.

- If the TRE fails, their city tax rate will be 52.4017¢ and they'll owe $1,676.

Now let's look at what they'll owe to other taxing entities.

- AISD taxes: $2,405 (92.52¢ & $140,000 exemption)

- Travis County: $1,202 (37.5845¢ & 20% exemption)

- Central Health: $377 (11.6¢ & 20% exemption)

- Austin Community College: $408 (10.34¢ & $5k exemption)

Total tax bill w/TRE: $6,228

Total tax bill without/TRE: $6,068

If they buy towards the bottom of the market — perhaps this $295,000 house in the Rundberg area — then they would pay $1,237 in city taxes and their overall tax bill would be $4,750 if the TRE passes and $4,632 if it doesn't.

Something to note: the more expensive your property, the bigger share of your total tax bill goes to AISD. To the state's credit, the flat $140k homestead exemption it implemented in school districts is more progressive than the percentage-based exemptions that cities and counties are allowed to put in place. (Someone with a $1 million home would have a total tax bill of $17,512, but the AISD portion alone would be $7,952.)

Buda

On the other hand, they could go down to Buda and get an extra bedroom and an additional 550 sq ft for $400,000. If they do that, they'll pay $1,430 a year in city taxes, based on Buda's recently-adopted FY 2025-26 budget. They would also pay the following:

- Hays County: $1,579 (39.99¢ & $5k exemption)

- Hays ISD: $3,313 ($1.2746 & $140k exemption)

- Austin Community College: $408 (10.34¢ & $5k exemption)

- Northeast Hays County ESD #2: $271 (6.78¢)

- Hays County Fire ESD #8: $400 (10¢)

Total tax bill: $7,401

But they could buy a 3/2 in for only $285,000 that would be about the same size as the Austin house. The city tax would be $1,018, and the total tax bill would be $5,271.

Kyle

If they really want to save upfront, they could score a $179,000 house in Kyle and they'd only owe $827 in city taxes & $2,519 total.

However, they could score a 4BR 2,200 sq ft house for $320k. They'd owe $1,668 a year in city taxes and $6,117 total.

Manor

According to the city of Manor, the average home price is only $289,000 (which could get you a 1,600 sq ft house) but the whopping 0.8537 tax rate would yield an annual city tax on that house of $2,467!! After adding school district, county, Central Health and ACC, the total tax bill would be $5,509.

$400k could land you a 5-bedroom, 2,500 sq ft house. The just the city property tax on that would be $3,414! The total tax bill would be $8,208.

Pflugerville

They could score a 1,350 sq ft house for only $300k in Pflugerville, for which would they would pay $1,605 in city taxes and $5,143 total.

If they want to go bigger, they could get a 2,000 sq ft house for $400,000, which would cost them $2,140 a year in city taxes and $7,376 total.

Round Rock

The city of Round Rock reports that the "average" home there is $376k. This 1,750 sq ft 4BR with a pool is listed for $374k. That would be $1,391 in city taxes & a total tax bill of $5,399.

You could get an older 1,278 sq ft house for $290k and pay $1,079 in city taxes and $3,888 overall.

Cedar Park

Cedar Park has a lot of high-priced homes these days. You can get a 1,850 sq ft 3/3 built in 2003 for $400,000. They'd owe $1,440 in city taxes and $6,323.

For something under $350k, you'd have to consider a townhouse or condo (funny how that works), like this 3/3, 1,400 sq ft condo for $305k. In that case they'd owe $1,098 in city taxes and $4,459 overall.

Hutto

I see a 1,700 sq ft 4BR in Hutto for only $270k. That would only cost about $1,042 in city taxes and your total tax bill would be $4,073.

If you want to live large (2,340 sq ft) for $396,000, you'll pay $1,523 a year in city taxes and your total tax bill would be $6,818.

Liberty Hill

Liberty Hill is a lot pricier than I imagined. There aren't many options for under $400k. I see a 1,183 sq ft house for $350k — that would cost $1,643 in city tax & a total tax bill of $6,241.

If you go for this 2,000 sq ft house for $400k, you'd pay $1,877 in city taxes and $7,380 total.

These figures are assuming that voters approve a tax rate election for the school district next month.

Georgetown

They could get a 2,000 sq ft house in a new subdivision in Georgetown for $390,000. That would yield $1,376 in city taxes and a total tax bill of $6,289.

They could get a 1,200 sq ft house for $300,000 –– they'd pay $1,094 in city taxes and have a total tax bill of $4,532.

Please tell your friends to get their own subscription to the Austin Politics Newsletter! And if you found this article particularly valuable, you can show your appreciation by buying me a cup of coffee to fuel further investigation and analysis of city politics.