Are density bonuses worth it?

& KUT's misleading tax calculator.

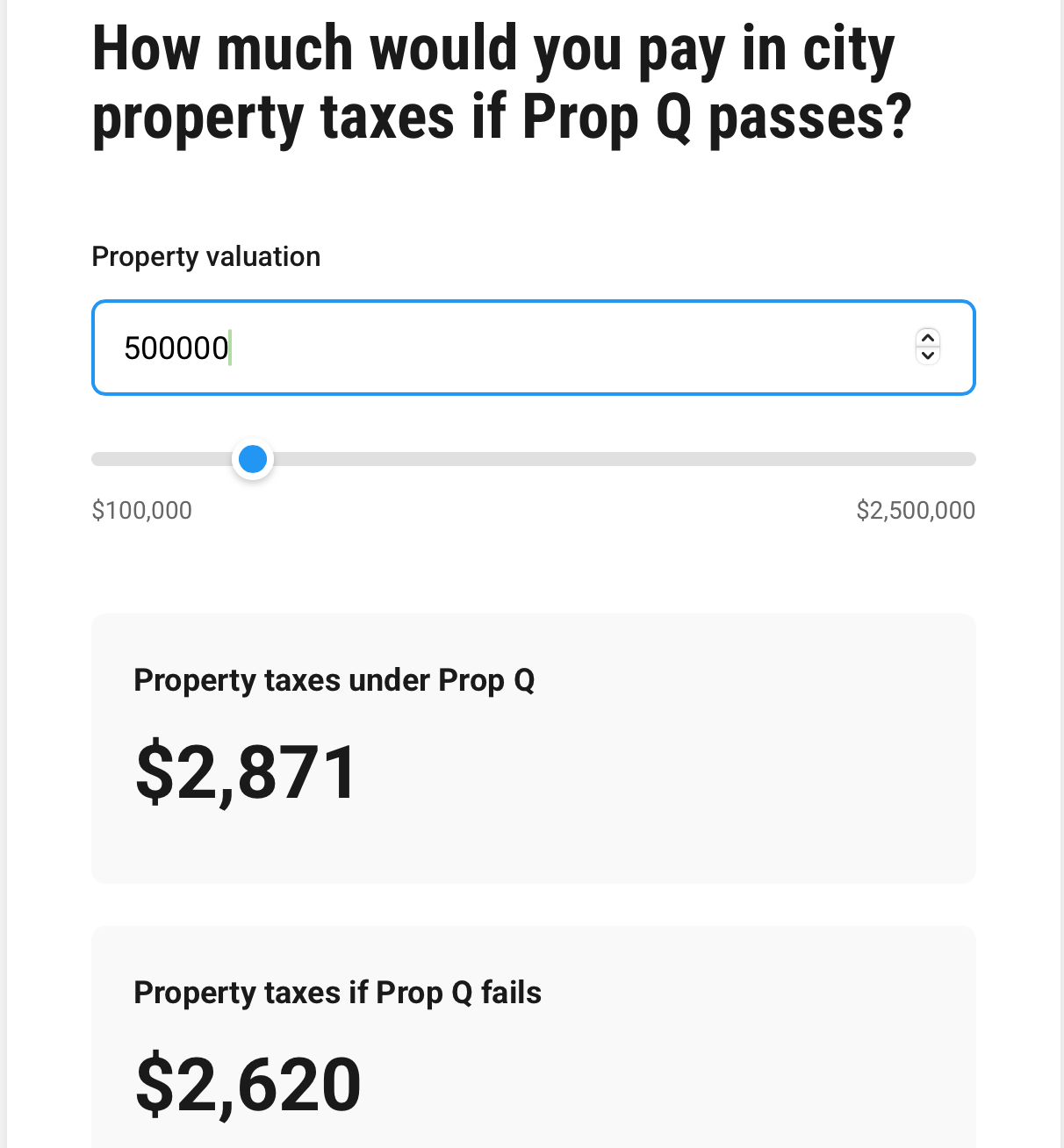

KUT has a Prop Q tax calculator. It's technically accurate, but I think it could still mislead a lot of people.

According to KUT's calculator, if your property is worth $500k, you would pay $2,871 if Prop Q passes and $2,620 if it fails.

That is accurate only if this property is not your home. If it is your primary residence, then it is eligible for the 20% homestead exemption. In that case, your city tax would be $2,296 if Prop Q passes and $2,096 if it fails.

Now, in KUT's defense, the last sentence of the article by Andrew Weber does say, "TCAD has its own calculator for your entire property tax bill, which includes any homestead exemptions you may have that we could not include here on a property-by-property basis."

I think that point deserved much greater emphasis. As it stands the calculator is only useful to owners of commercial or rental properties. That's a relevant point, but it's certainly not the most relevant one to most KUT listeners.

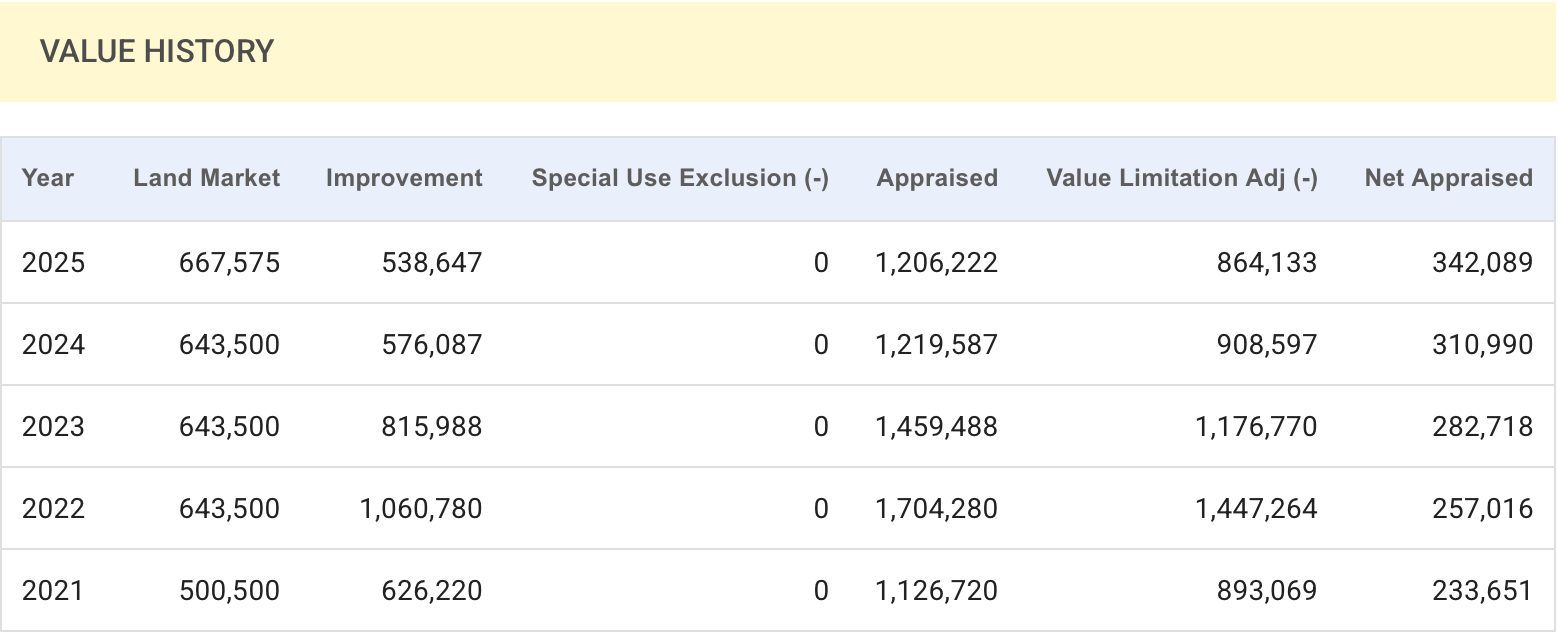

Here's another point about the homestead exemption: Not only does it grant you a 20% exemption on your city taxes and a $140k exemption on your school taxes, but it prevents the taxable value of your home from increasing by more than 10% per year.

An extreme example below is a property on the east side that has been owned by the same person since 1996. It was appraised this year at $1.2 million but the amount that is subject to tax is only $342k.

The result isn't less money for local governments. For better or worse, it just shifts more of the tax burden on to commercial properties and, arguably, renters.

Instead of affordable units, tax revenue?

Last week, City Council adopted changes to the Downtown Density Bonus that included putting in place a height restriction on new projects in the Central Business District.