It's the police spending

Back the Blue ≠ low taxes

There is a certain group of people in Austin who consistently say two things:

- The city has a huge spending problem, taxes are too high

- The city needs to hire way more cops and pay them a lot more

Part of me wishes these people were elected to City Council and got the chance to see how contradictory these impulses are.

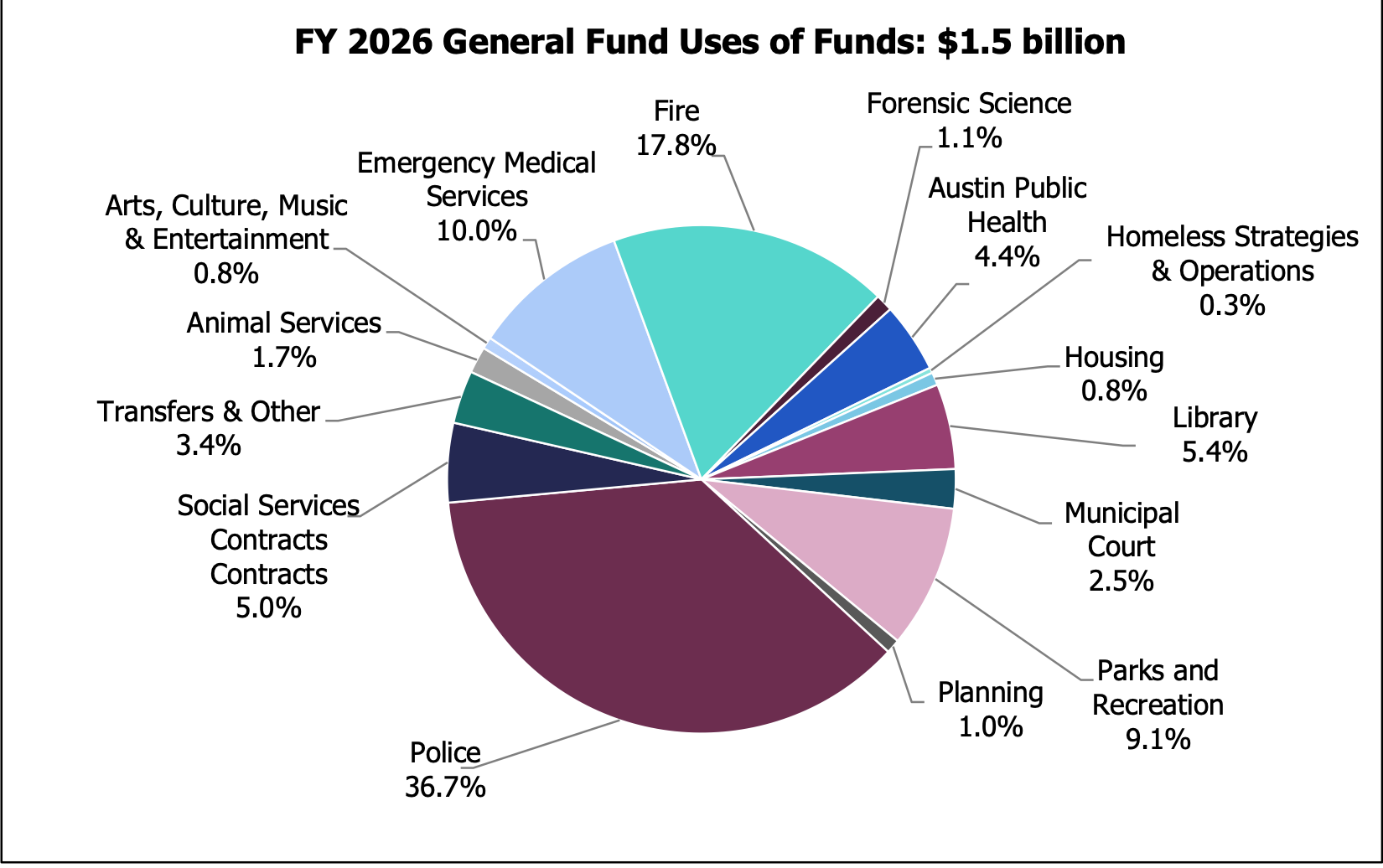

Let's take a look at the three biggest spending categories according to the general fund budget that was proposed by City Manager T.C. Broadnax earlier this summer. To be clear, this is the budget that was proposed before City Council added spending to prompt a tax rate election.

- Police: $542M

- Fire: $263M

- EMS: $148M

Total: $953M

Now let's look at tax revenue for the general fund this year (if the tax rate election doesn't pass):

- Property tax: $708M

- Sales tax: $360M

Total: $1.068B

Spending on police, fire and EMS is equal to 89.2% of property and sales tax revenue in the general fund.

The next biggest cost driver is the Parks Department ($134M).

So spending on these four departments ($1.087B) exceeds the city's total general fund tax revenue.

So how does the city still have money to spend on other stuff, namely libraries and social services? Well, there are state and federal grants from time to time, but the biggest consistent source of money is the Austin Energy General Fund Transfer, which this year amounted to $139 million. The GFT is supposed to be function like a dividend that a private utility would pay its shareholders, but in this case the shareholders are the general public.

The point is that your city property taxes are not funding a vast welfare state. They don't even cover the police and fire departments.

Now, the roughly $110 million that City Council has proposed adding to the budget via a tax hike (pending voter approval in November) is heavily tilted towards social services, particularly homelessness. It would add about $40M in homelessness spending this year and $23M in social service contracts.

(The perception that the city has spent a lot on homelessness is correct, but much of that came from the $101M in federal funds the city received from the 2021 American Rescue Plan Act. Much of the proposed new spending aims to continue programs that will be cut due to ARPA dollars expiring)

But the thing is...even if voters approve the tax hike, a lot of the money earmarked for social services will eventually get moved over to the public safety departments in the years to come unless voters approve another tax hike. Why? Because the pay raises City Council approved for cops last year guarantees the police budget will grow faster than the overall budget.

If you're mad about taxes ...

First off, if you're mad about taxes the people you should really be mad at are Republicans at the State Legislature. The biggest part of your tax bill is the Austin Independent School District, and more than half of the dollars you pay to the school district is taken by the state. The state has tens of billions of dollars at its disposal but it would prefer to simply pummel property owners in Austin and other "property-rich" cities and towns to fund public education in Texas.

If you're mad about city taxes...

$185M of city property taxes goes to the Austin Transit Partnership to fund Project Connect, the voter-approved mass transit initiative that has been significantly scaled back and delayed. The way the project has played out has been deeply disappointing, reflecting the worst tendencies of the American public sector, which has seemingly forgotten how to build transit systems that it built with relative ease 100 years ago and that continue to be built in Europe and Asia at a fraction of the cost. Austin deserves a world-class public transit system, and that's not what it's getting. And it's this kind of underperformance that will fuel resentment of local government and resistance to new taxes.

And then there's $253.5 million the city is spending on debt service for general obligation bonds. The vast majority of this debt was approved by voters to fund capital projects: roads, sidewalks, parks, libraries, subsidized housing, flex posts. The voters approved spending on these projects for good reasons, and it has produced good things.

But there has also been no shortage of disappointments. In 2016 voters approved a major transportation bond that promised to remake nine of Austin's major traffic corridors within eight years. Nine years later, most of the projects are far from done and in need of additional funding to be completed. There was the pandemic and inflation etc but there was also bad planning and instances of the city getting in its own way (e.g. its dumb land development code driving up the cost of construction).

From the perspective of a taxpayer, there's no distinction between infrastructure spending and general operations spending. It's all coming from your pocket. But they are funded by two distinct tax rates. State law only limits maintenance and operations taxes, which is what the city must raise to pay for ongoing services.

If you want efficiency...look at public safety

If you really want the city to rein in spending long-term, then your focus should be on increasing the efficiency of public safety services. EMS, recognizing that much of its work is poverty care, not emergency care, has sought to slim down the resources it spends on low-acuity calls. And following a policy change announced last month, fire trucks will no longer be dispatched to nearly as many medical calls. That's a good start ...

But what about police? The simple fact is that the city continues to lean heavily (and expensively) on police to address problems the police are not equipped to handle. Hiring more cops is not going to eliminate the human misery and public disorder that bedevils my former neighbors at Menchaca and Ben White. Those are issues better-addressed by services that the city spends relatively little on.

A 2021 state law bars the city from ever reducing its police budget, but long-term the city needs to figure out a way to tame the increases. Otherwise you better get ready for more tax rate elections.

If you were forwarded this email, please visit the website to sign up for more daily insights on city politics and government.