The house doesn't always win

Austin's housing market is not invincible.

The idea that housing prices are guaranteed to rise is not unique to Austin, but I would guess that it's particularly pronounced here.

Unlike in many other parts of the country, home values here didn't plummet 15 years ago in the wake of the subprime mortgage crisis. There was a relatively simple economic explanation: our industries (tech, govt) weathered the recession well, so people kept moving here and demand for housing remained high. But for some reason many otherwise rational people in town have long subscribed to a type of Austin exceptionalism that holds that our housing market exists independently from basic economic principles.

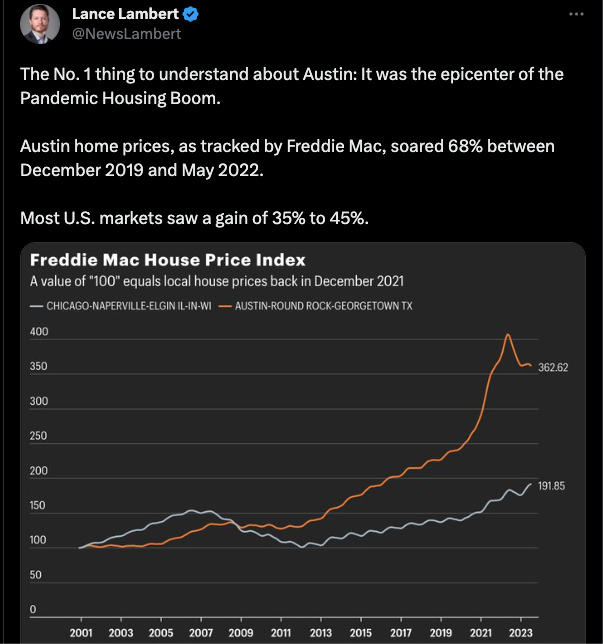

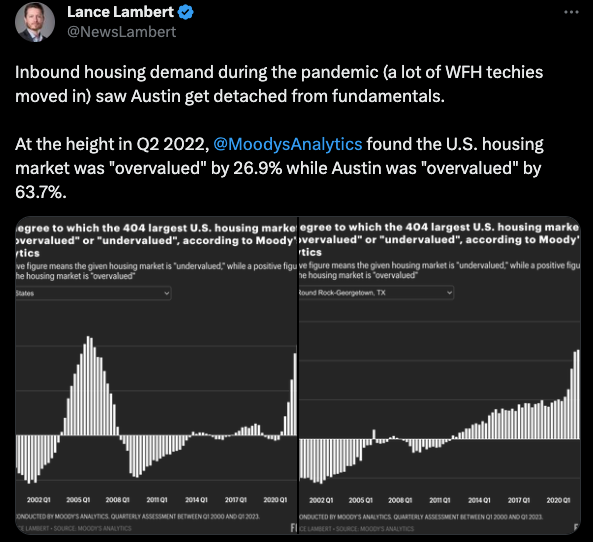

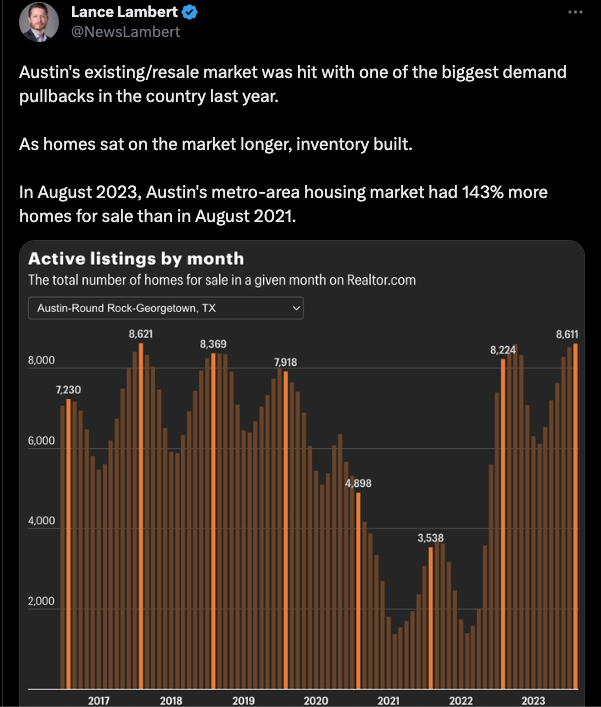

If you've followed news on the local housing market in recent months, you probably know where this is going. Lance Lambert, Fortune's real estate editor, has some figures and analysis. Here are the points I found most interesting:

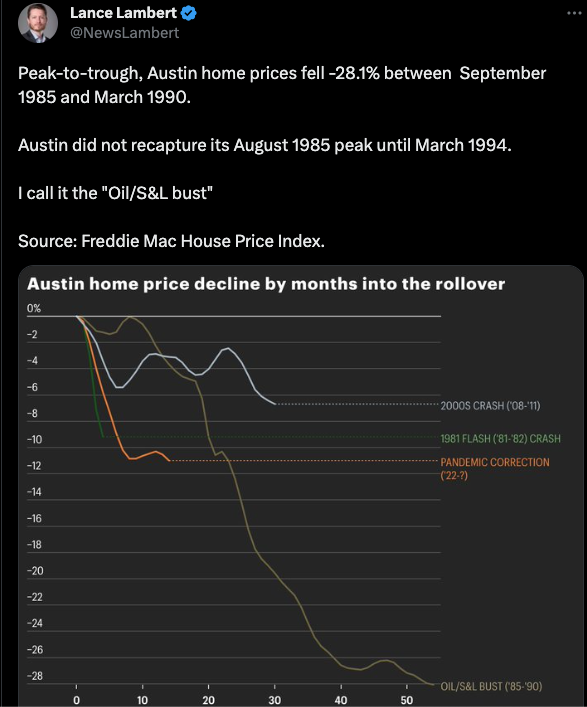

Austin home prices have further to fall

— Lance Lambert (@NewsLambert) September 9, 2023

During the '00s crash, it took Austin 30 months to fall 6.7% peak-to-trough

This time around, Austin has fallen 11% in just 14 months

How did Austin—which dodged the worst of the 08 crash—become the epicenter of the pandemic correction? pic.twitter.com/QVpnmRZ0RM

See? I told you supply & demand is a thing!

Lambert notes this isn't Austin's first experience with a major market correction. The housing market took a major dive in the late 80's, largely due to the Savings & Loan crisis and a major slump in the oil economy.

More importantly...rents!

Chad Swiatecki of the Austin Monitor reports:

A combination of softer demand by renters and new multifamily apartment units completing construction has caused some lowering of rents in the Austin market, according to members of the Austin Apartment Association.

“Demand has been pretty muted now for really about a year and a half, maybe a little more than that, and so the new construction activity combined with that needed demand has really brought occupancy back down not only to a normal level before the run-up in 2021, but actually to below where they were going into the pandemic,” said Jordan Brooks, senior market analyst with ALN Apartment Data.

When there are fewer customers and more competition, prices fall. Whuda thunk it? Talk all you want about the shadowy cabal of global investors pumping billions of dollars into Austin's real estate market –– their investment only pays off if there are enough people who need places to live.

Do declining prices mean we don't need reform?

Of course not. First, Austin's housing market is still extremely unaffordable and we should allow and encourage builders to provide cheaper forms of housing, both for renters and buyers.

Plus, the Austin metro area is still growing and will continue to grow. I would prefer that as much of that growth occur in existing neighborhoods than through sprawl.

Subscribe to the Austin Politics Newsletter to get articles like this 4x a week in your inbox.