What will a tax hike get Austin?

How high will voters go?

It is almost certain that Council will pass a budget next month that requires voters to approve a tax increase in November above the 3.5% state limit, but it is not yet clear how high they'll go.

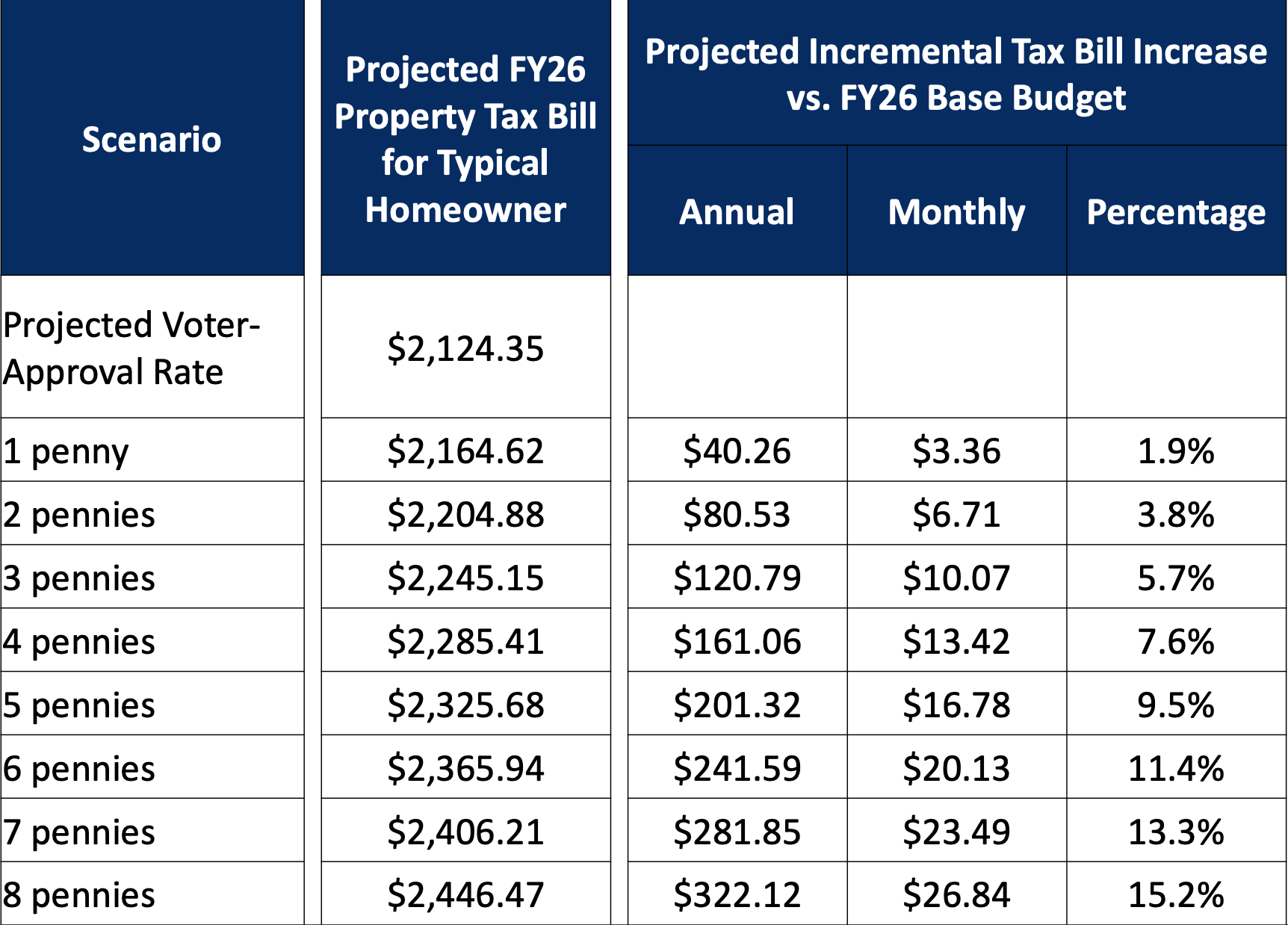

Each additional "penny" –– ¢1 per $100 of property value –– would generate roughly $21.6 million in revenue per year. And each penny would add roughly $40 to the annual tax bill for the median Austin homeowner.

What's important to remember is that the cost of just maintaining existing service levels –– no new employees, no new programs –– increases each year. In particular, the cost of compensating the city's largest employee group, the police, will significantly rise in each of the next few years due to the very generous police union contract City Council approved last fall.

The city budget office recently posted a series of scenarios tied to different tax rate hikes. Let's take a look.

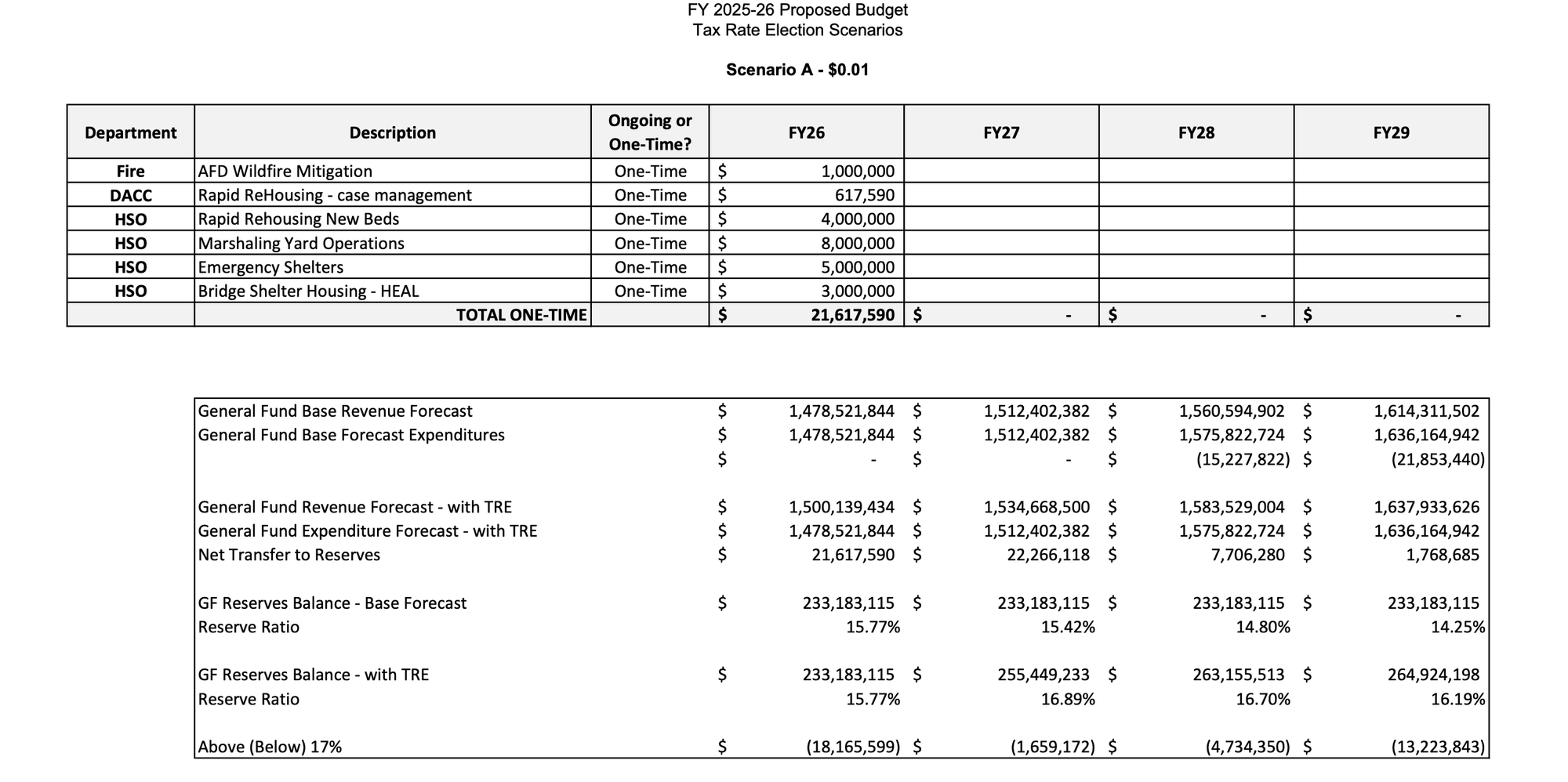

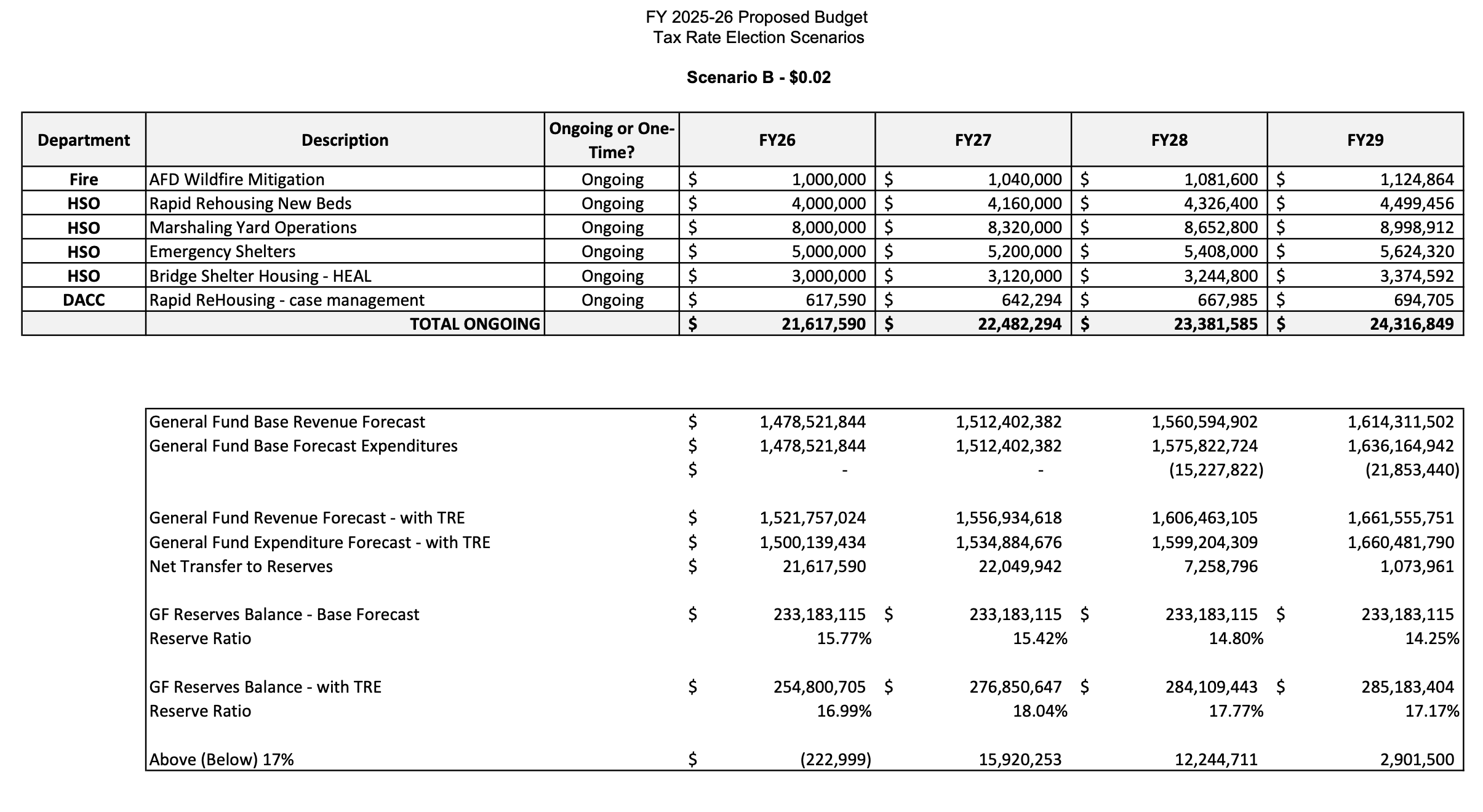

As you can see below, a 1¢ increase would not do much. It would be enough to keep existing services afloat for another year, including $20 million of homeless sheltering services and a $1 million wildfire mitigation program, all of which are currently being funded with one-time monies:

But the following year, Council would once again be forced to either make cuts or dig deep into its budget reserves, which the city's current financial policy states should equal 17% of the general fund.

A 2¢ hike would allow the city to fund that handful of services continuously and keep the budget reserves at around the 17% level for at least four years.

FOUR YEARS is an important timeline to keep in mind, because the tax rate election policy that Council approved in May says the city will not hold a TRE more than once every four years. Council could choose to disregard that policy, but it's at the very least an important psychological anchor they've imposed on themselves.

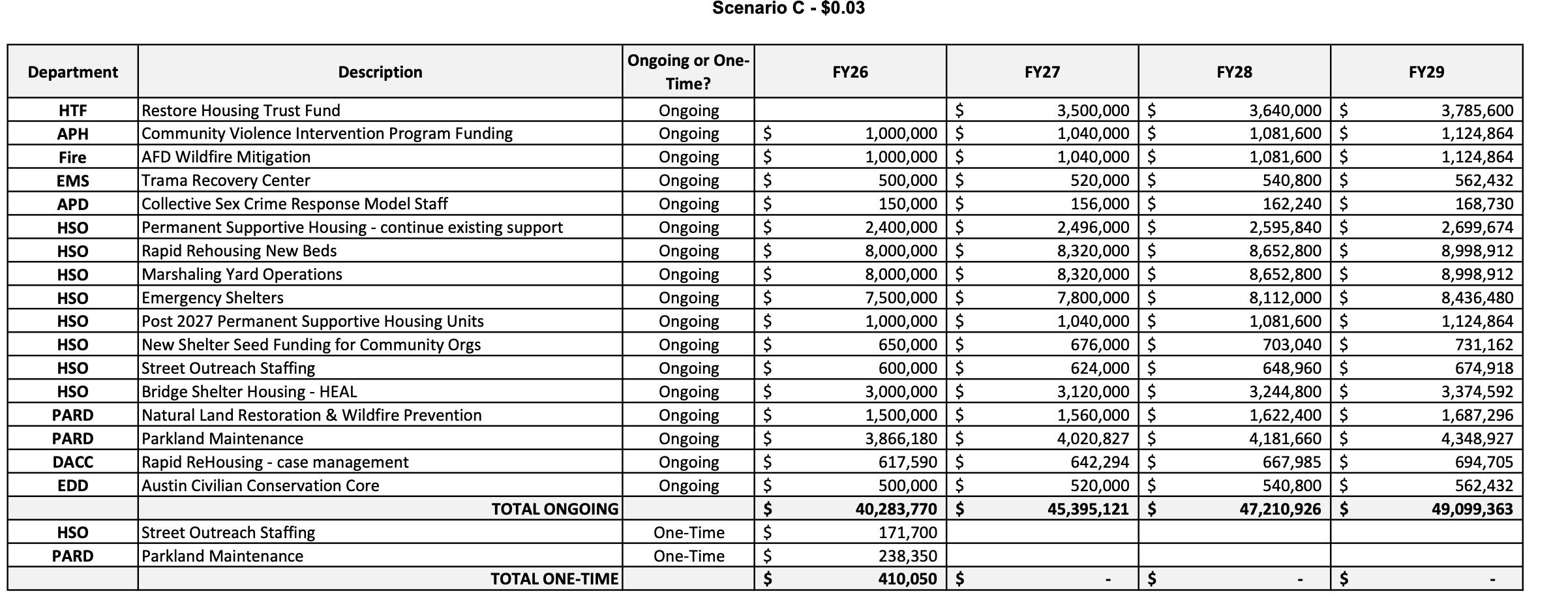

Here's the 3¢ scenario:

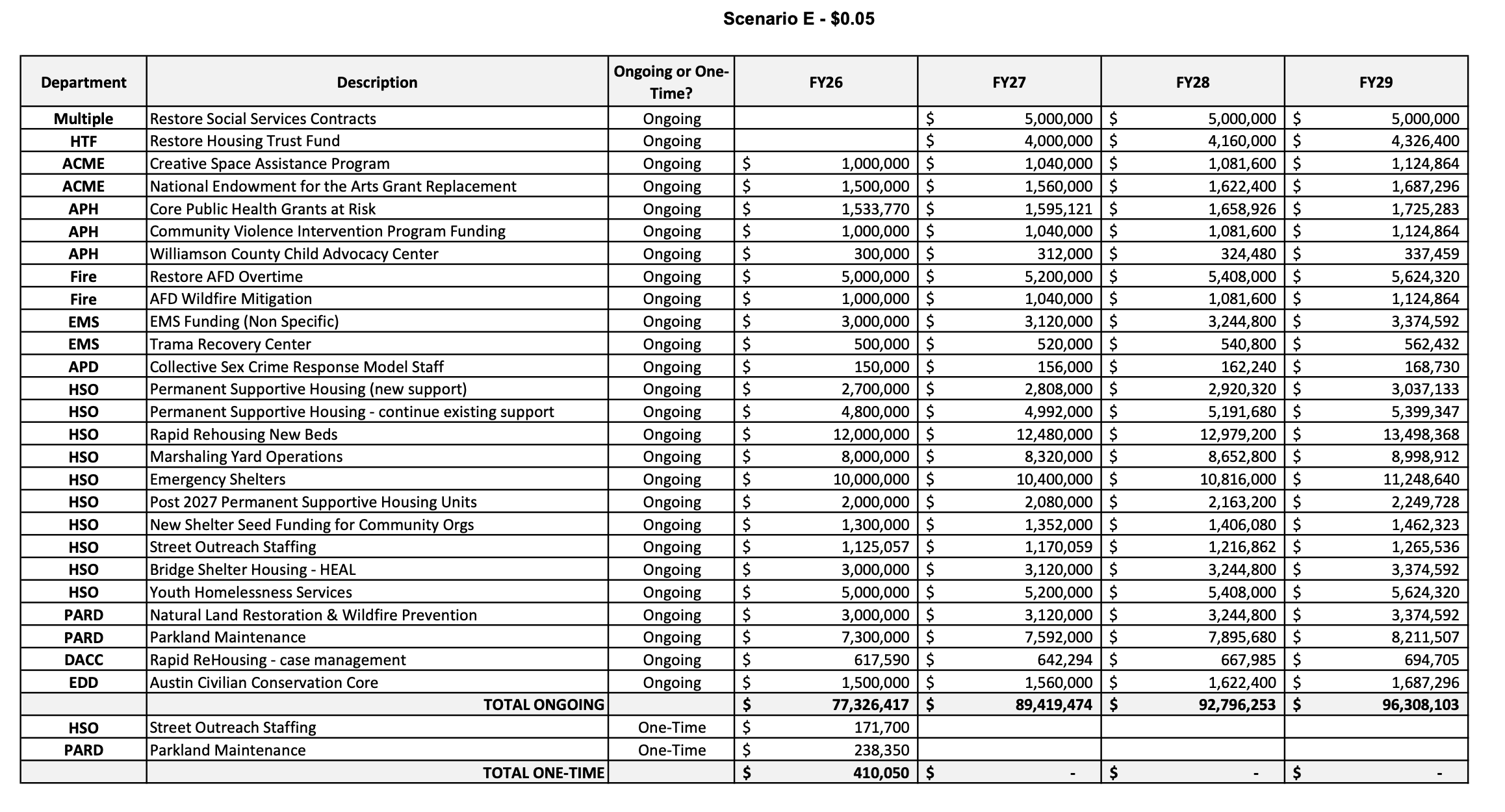

And 5¢:

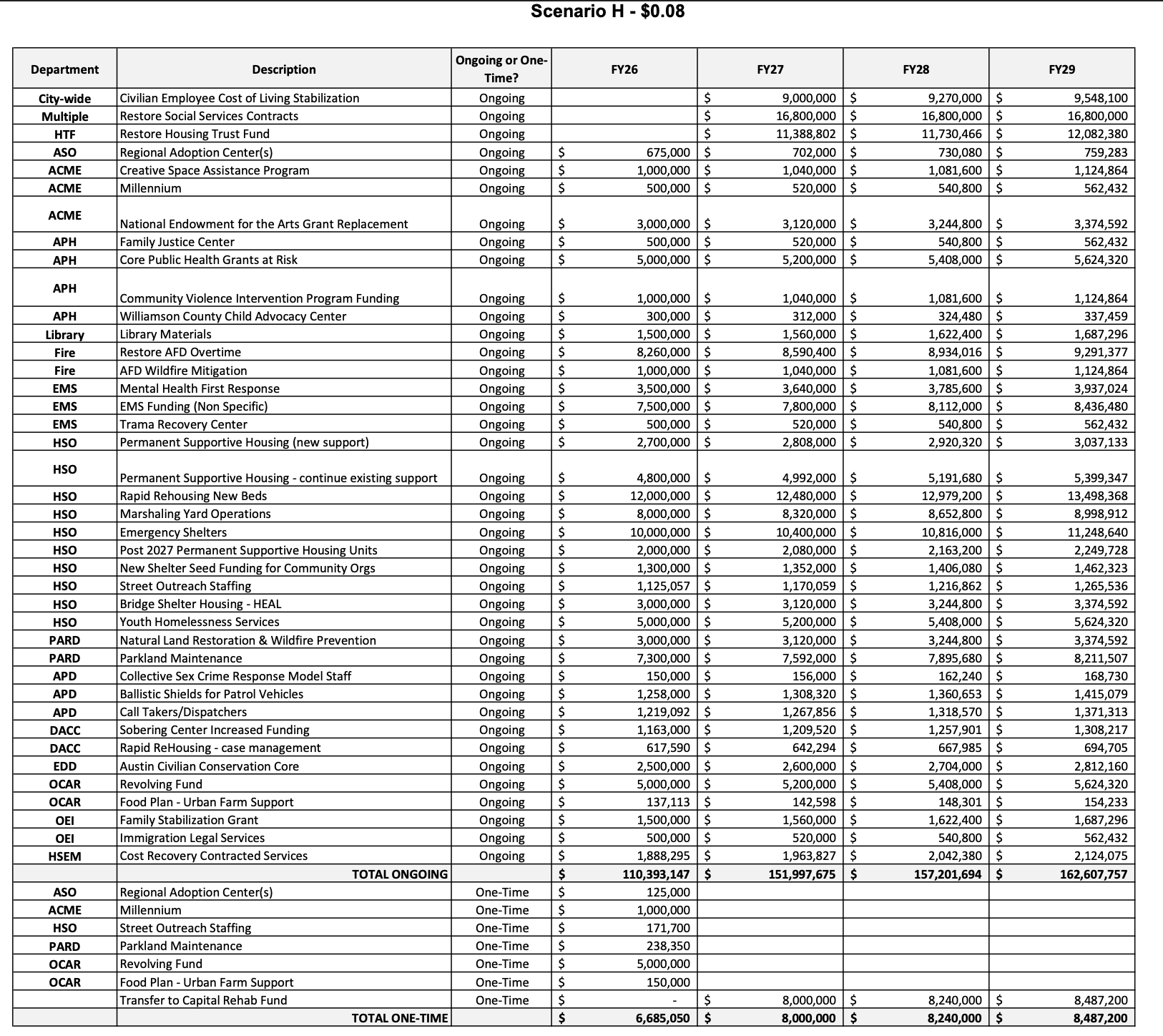

And 8¢:

This last scenario would generate over $110 million additional dollars in the upcoming fiscal year and be enough to fund all kinds of stuff. In addition to the $20M in homelessness services preserved in Scenario A, it would add another roughly $30M per year for permanent supportive housing, services for homeless youth, increased emergency shelter and more rapid rehousing, where the city simply pays to get people into private sector apartments temporarily. It would also inject $7.3M into park maintenance, another $7.5M of nonspecific funding for our Austin's beleaguered EMS department, another $3.5M to EMS to increase mental health response...a lot of stuff!

To be clear, these are just suggestions from staff. Council could go for an 8¢ tax hike and choose to fund other programs than the ones listed here.

The right to reserve

In theory, Council could support a fairly big tax increase but opt for a big chunk of the new tax revenue to simply flow into reserves, offering the city more breathing room to increase services and/or employee compensation in the coming years.

But the TRE policy that Council adopted says that any proposed TRE should be tied to plans to fund specific programs.

As I wrote in May, I think it is a mistake for Council to frame a potential tax hike as paying for new services. If it is described that way, then the electorate will view it as non-essential. The fact is that the TRE must pass or the city will have to make progressively draconian cuts, including to core public safety services.

I really don't have a sense of where Council will land on this yet. Nobody is publicly floating numbers yet.

If you were forwarded this email, please visit the website to sign up for daily insights on city politics and government.