How much do you really need to afford housing in Austin?

It's important people have accurate data.

The city of Austin is in a peculiar political spot when it comes to affordable housing.

After more than a decade of angst over the rapid increase in housing costs, rents have now fallen for three years, reducing some of the pressure on city leaders to take action. Tax fatigue may have also sapped enthusiasm for increased investments in subsidized housing via housing bonds.

But the problem of housing affordability certainly remains.

Last week the City Council Housing Committee got a presentation from housing staff on City Manager T.C. Broadnax's ongoing efforts on affordable housing. A few things stood out to me.

Do you really need to make $62k to afford a studio in Austin?

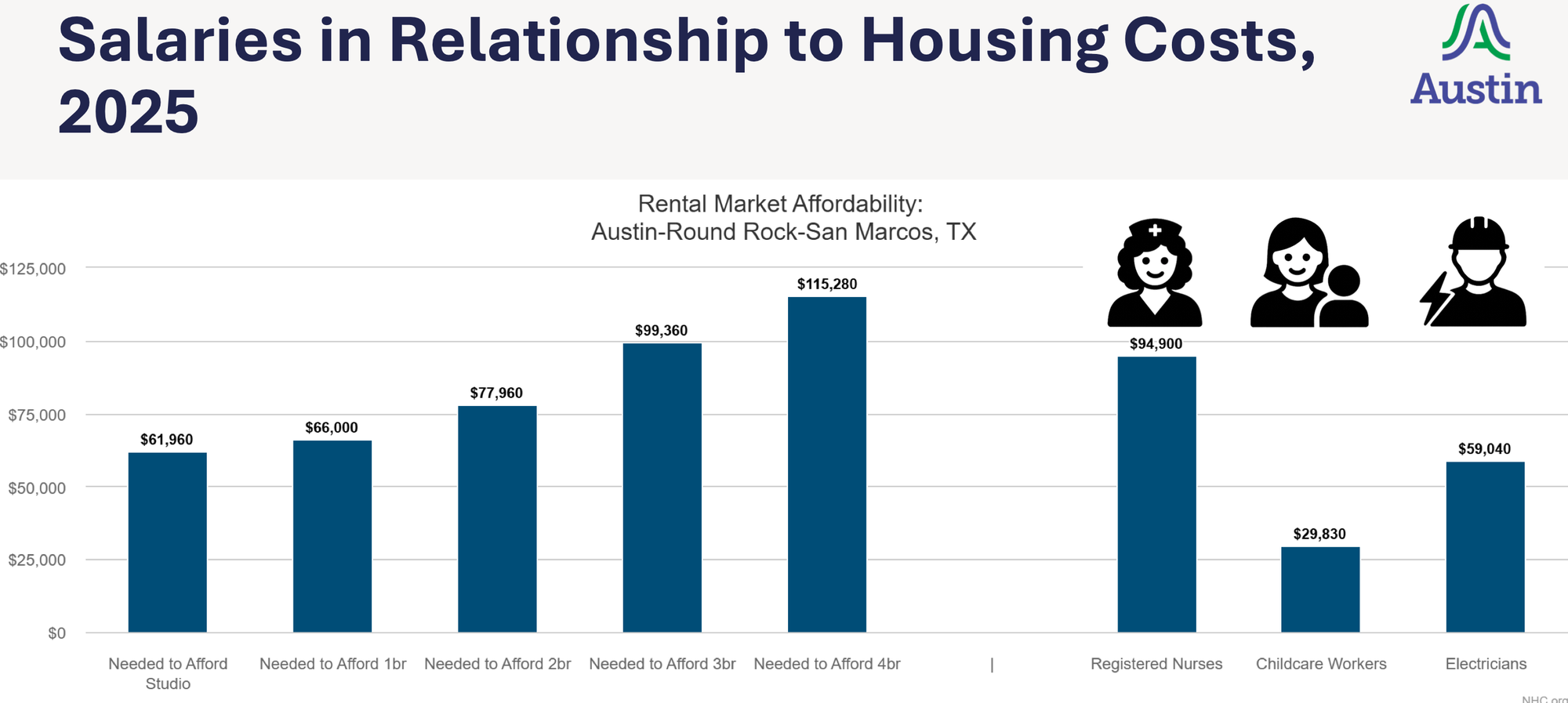

The first is this chart that purports to show the income you need to afford different types of housing in the Austin metro area:

The data comes from the National Housing Conference. They have a pretty cool tool that allows you to compare the income needed to afford a unit at a given size in a given metro area. It also compares those figures to the average earnings of different professions in that metro area.

It's a cool tool, but it doesn't seem terribly accurate.

You don't need to make $62,000 a year to afford a studio apartment in Austin, let alone the broader metro area, where housing is even cheaper.

A unit is deemed affordable if it accounts for no more than 30% of your income. So if your income is $62k, your max annual rent should be $18,600 – or $1,550 a month.

You can find studios for WELL under $1,550 a month in Austin. You can find 1BR and 2BR units for under that price – in nice neighborhoods! Here's a 2BR at an old complex in Tarrytown for $1,400.

My point isn't that housing affordability isn't a major issue, but this data gives us the wrong impression of who is struggling in this market. A childless professional making $60k/yr is not struggling to find a place to live, but a single mother of two making $50k/yr is.

This might seem nitpicky, but I think it's very important that the city be precise in identifying those who are actually in need. Otherwise it could end up committing resources to serving those who are already being served by the market.

These kinds of false data points are dangerous because they become ingrained in the psyche of elected officials and often serve as the basis for bad policy. It's similar to the periodic story done by a local news outlet about how many hours of minimum wage work you need to afford housing in Austin, even though it's been many years since anybody in Austin actually made $7.25/hr. This information is not helpful!

What to do about density bonuses?

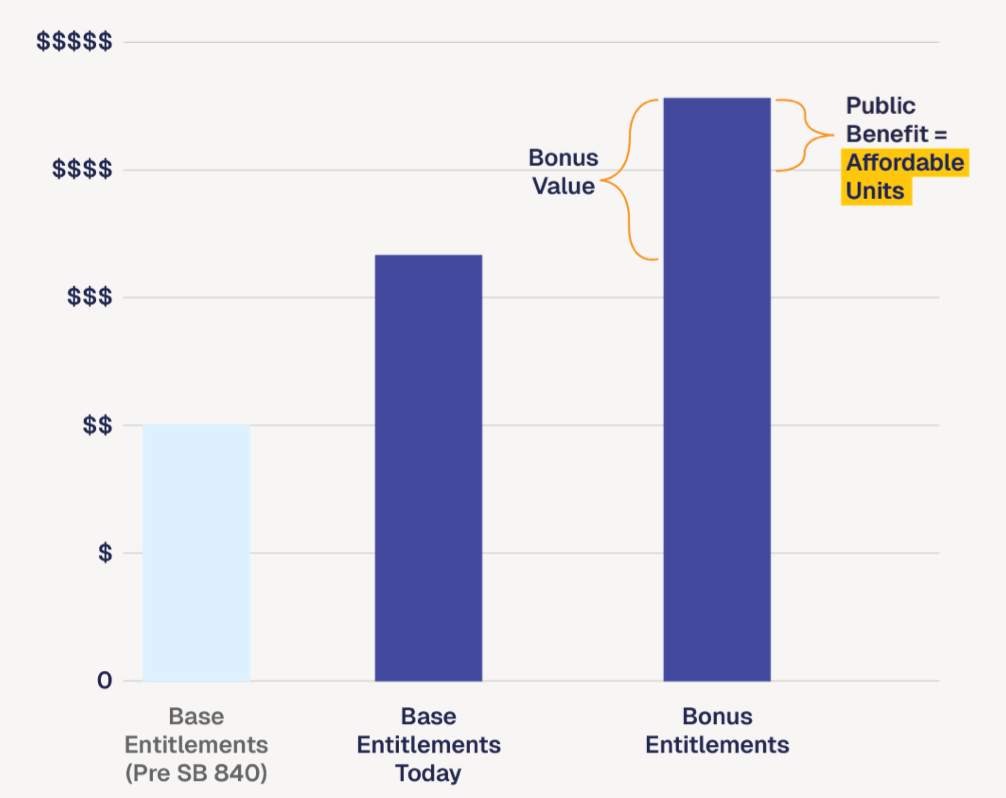

Information about who needs housing and what kinds of housing they need will be particularly helpful as the city considers revamping its density bonuses — the programs that offer developers additional entitlements in exchange for a certain amount of income-restricted housing.

There is some concern that some of the city's existing density bonus programs were undercut by the passage of state legislation last year that sharply restricted the limits cities could put on development on parcels with commercial zoning. Cities must now allow residential development on those properties and must allow a minimum height of 45 ft.

The graphic below illustrates the perceived leverage the city has lost as a result of SB 840:

City Council already adopted changes to the Downtown Density Bonus in response to the law and city staff is in the process coming up with a new program for the rest of the city.

There is debate about whether density bonuses are worth it. I think even the most adamant DB supporter would recognize they are never going to be the primary mechanism of generating below-market rate units. The main source of such housing will be dedicated affordable housing developments that rely on a variety of public subsidies, such as federal tax credits or housing bonds approved by city voters.

The power of vacancy

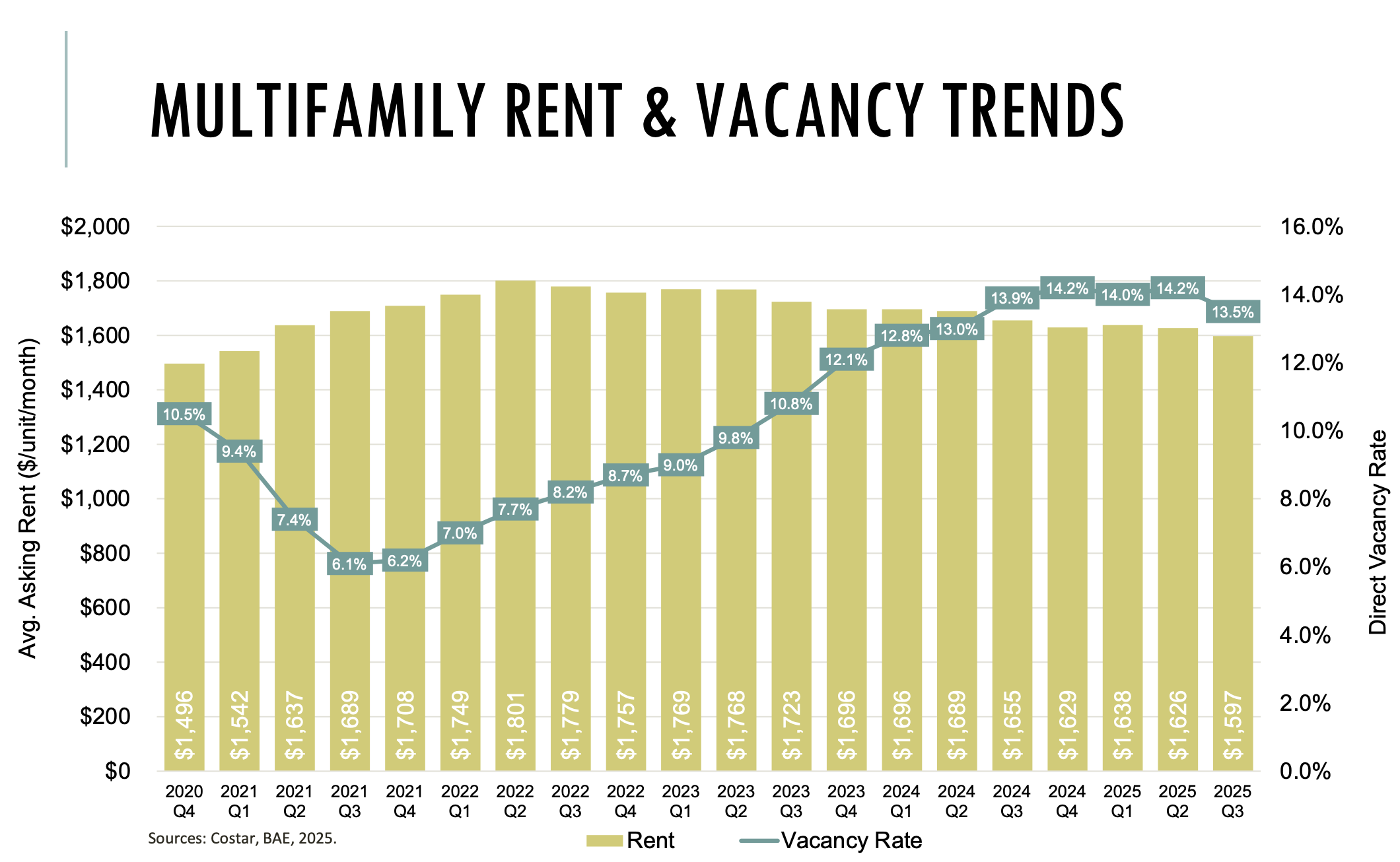

This chart from the presentation is based on data gathered by Costar, a real estate analytics firm. It shows how the drops in average rents correspond to the rise in vacancy rate.

Please tell your friends to get their OWN subscription to the Austin Politics Newsletter!

Become an APN sponsor! Get your brand in front of a loyal readership that includes many of the city's top decision-makers. Check out prices here.